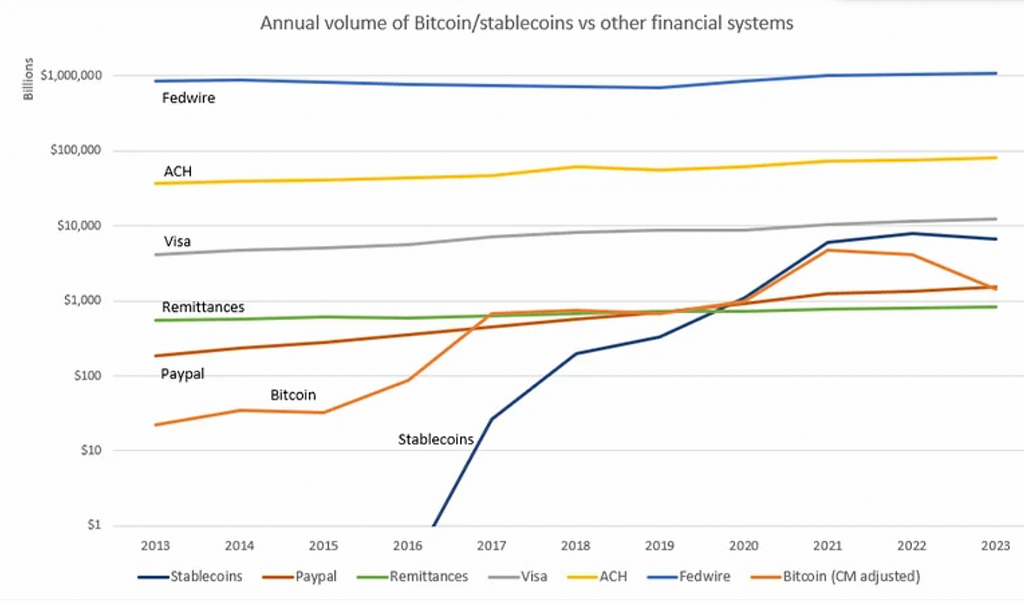

Over the past decade, the financial world has witnessed a revolution. What once seemed like distant possibilities — cryptocurrencies and stablecoins — have rapidly grown into legitimate players in the global financial ecosystem. The data speaks for itself: the annual transaction volumes of Bitcoin and stablecoins are no longer fringe competitors. They’re rapidly closing the gap with traditional systems like PayPal, Visa, and even major banking infrastructures like ACH and Fedwire.

The Rise of Bitcoin and Stablecoins

Bitcoin, originally viewed as a speculative asset, has evolved into a multi-trillion-dollar network facilitating borderless, decentralized transactions. Its growth has been nothing short of extraordinary, particularly as it begins to challenge legacy systems that have been around for decades. From 2013 to today, Bitcoin has gone from a niche payment option to a viable alternative for remittances, store of value, and even institutional investments.

Meanwhile, stablecoins have quietly become the unsung heroes of blockchain technology. By pegging their value to fiat currencies like the U.S. dollar, stablecoins combine the speed and efficiency of crypto with the stability of traditional money. Over the past few years, their adoption has exploded, becoming essential tools for cross-border payments, decentralized finance (DeFi), and reducing friction in global transactions. Between 2017 and 2023, stablecoin volume skyrocketed, outpacing many traditional systems and creating a new benchmark for digital liquidity.

How Legacy Systems Compare

While the growth of Bitcoin and stablecoins is impressive, systems like Visa, PayPal, and ACH are not standing still. Visa remains a global powerhouse, processing trillions annually with unmatched speed and scale. ACH continues to handle massive domestic transaction volumes in the United States, and PayPal remains a household name for convenient digital payments.

However, as the image shows, legacy systems like Fedwire and ACH have seen relatively slower growth compared to the exponential rise of blockchain-based solutions. What this highlights is not the obsolescence of traditional finance but rather the diversification of financial tools available to individuals and institutions alike.

What This Means for the Future of Finance

The convergence of traditional and blockchain-based systems signals a new era of finance — one where choice, speed, and accessibility reign supreme. Bitcoin and stablecoins represent not just technological advancements but also a shift in consumer behavior. People now demand transparency, lower fees, and the ability to transact globally without barriers. The financial systems of the future will be a blend of the old and the new, leveraging the strengths of both traditional institutions and decentralized networks.

For businesses and financial institutions, this is a wake-up call. Adapting to this shift isn’t optional — it’s essential. Whether it’s integrating stablecoin payments, supporting Bitcoin transactions, or simply understanding the evolving financial landscape, the time to act is now.

BankSocial: Bridging the Gap

At BankSocial, we’re at the forefront of this financial revolution. By providing credit unions and financial institutions with the tools to integrate blockchain-based solutions, we’re empowering them to stay competitive in a rapidly changing world. Whether it’s enabling stablecoin transfers, facilitating Bitcoin transactions, or building secure, scalable infrastructure, we help bridge the gap between traditional and decentralized finance.

The numbers tell a clear story: the future is decentralized, but it’s also inclusive. With the right tools and mindset, we can embrace this change and build a financial system that benefits everyone.

Let’s build the future of finance — together.

Interested in learning more? Just reach out!

was originally published in BankSocial News on Medium, where people are continuing the conversation by highlighting and responding to this story.

View more

View more